The U.S. is about to see its first exchange-traded funds (ETFs) tied to XRP and Dogecoin, with launches expected this week following clearance from the Securities and Exchange Commission. Approved under the Investment Company Act of 1940, the products are a major move towards mainstreaming altcoins in the financial market.

Fund manager REX-Osprey announced Monday that its XRP ETF, trading under the ticker XRPR, is scheduled to begin trading on Friday. The fund will provide spot exposure to XRP, the world’s third-largest cryptocurrency by market capitalisation.

The ETF moved forward after completing the SEC’s 75-day review window without objections. The 1940 Act structure, unlike the Securities Act of 1933, used for spot Bitcoin ETFs, allows new products to go live automatically unless regulators raise concerns.

Analysts say the decision highlights regulators’ growing openness to crypto ETFs beyond Bitcoin and Ethereum. “This will be another good litmus test for demand,” said Nate Geraci, president of consultancy Nova Dius, pointing out that futures-based XRP ETFs are already approaching $1 billion in assets.

The XRP product will be followed closely by a Dogecoin ETF, slated for Thursday, according to Bloomberg ETF analyst Eric Balchunas.

It will become the first U.S. ETF to be topped with a memecoin under the ticker DOJE. Although Dogecoin was initially a joke, it has a strong community following with an active trading market that has solidified its position as one of the most widely traded cryptocurrencies. Its sanction by the identical framework of the 1940 Act highlights the increasing demand by investors for diversified exposure to crypto.

REX-Osprey has been steadily building its presence in the crypto ETF sector. In July, it launched the Solana Staking ETF (SSK), which now manages around $274 million in assets, though inflows have slowed in recent weeks. The firm also filed for a BNB Staking ETF in late August, signalling its push to broaden the range of altcoin-based products.

The XRP and Dogecoin launches come amid a surge in crypto ETF filings. As of late August, more than 90 products were pending SEC review, according to Bloomberg analyst James Seyffart.

Among them:

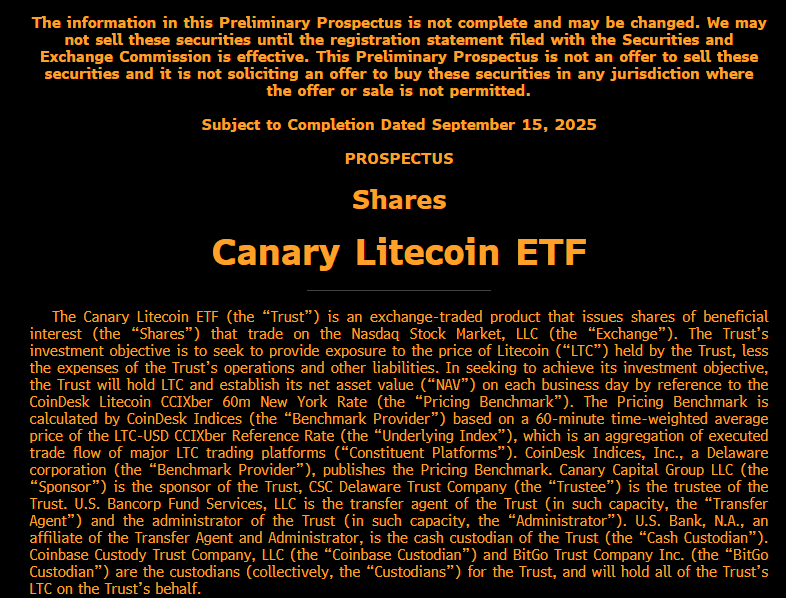

Canary Capital Litcoin ETF prospectus. Source: James Seyffart

Not all proposals are moving forward quickly. The SEC has delayed decisions on several products, including Bitwise’s earlier Dogecoin ETF filing and Grayscale’s Hedera ETF, pushing their deadlines to November 12.

The arrival of XRP and Dogecoin ETFs highlights a shift in how altcoins are perceived by regulators and traditional finance. By using the 1940 Act, issuers gain a faster path to market while giving investors a regulated way to access cryptocurrencies beyond Bitcoin and Ethereum.

Whether these ETFs attract meaningful inflows remains to be seen. Interest in Solana’s ETF has been modest, suggesting demand for altcoin funds may vary. Still, the launch of XRPR and DOJE marks a milestone: the first ETFs of their kind in the U.S. and a possible sign of more altcoin products to come.

The next few days will be a key test for investor appetite as these landmark funds begin trading.