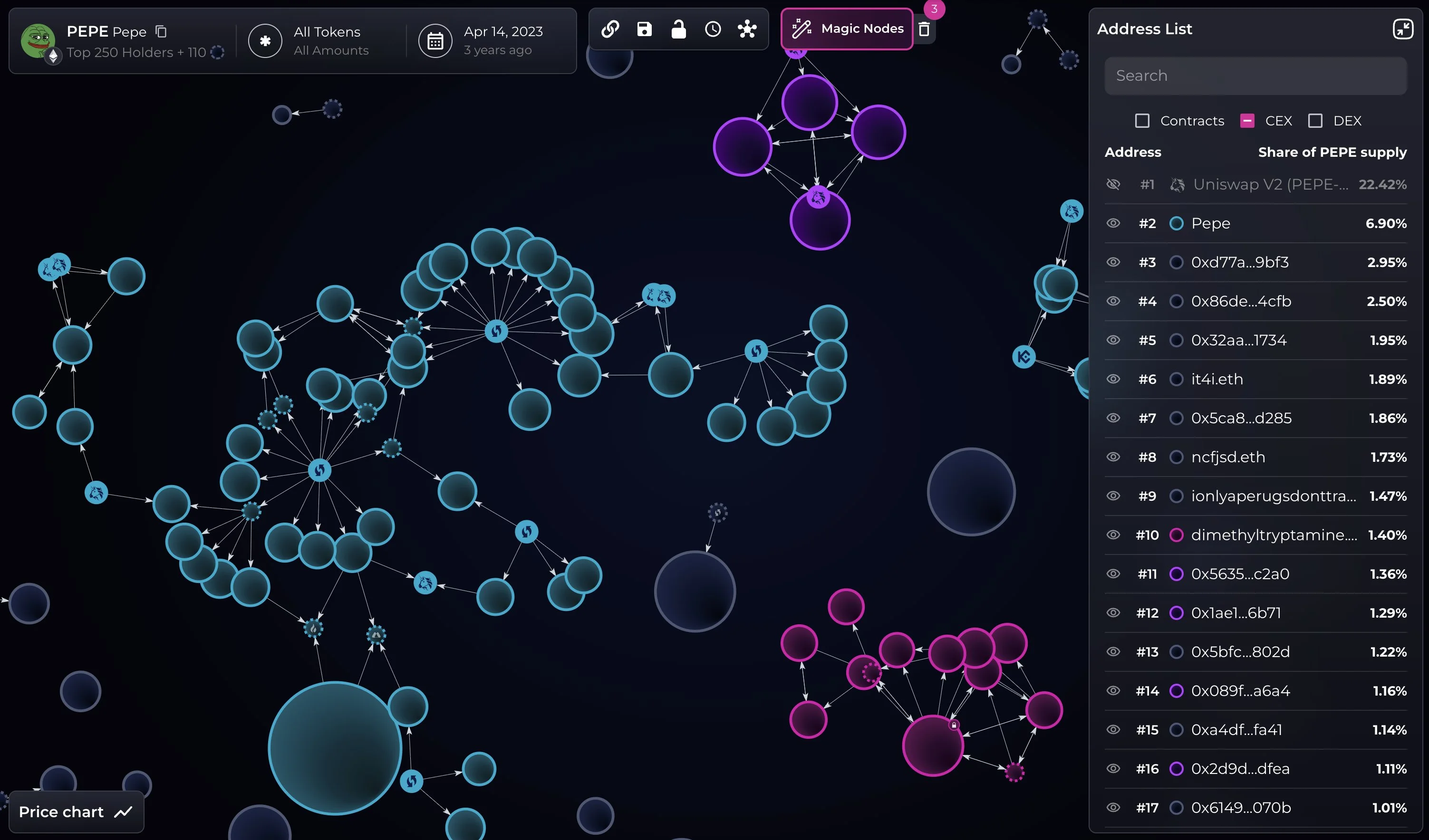

The popular narrative surrounding the Pepe (PEPE) memecoin as a truly decentralized "coin for the people" is being strongly challenged. New analysis from the blockchain data visualization platform Bubblemaps suggests that nearly a third of PEPE's initial supply was actually controlled by a single, concentrated entity right at the token's launch in April 2023.

Bubblemaps recently published their findings, effectively claiming that the original promise of a "stealth" launch with no presale was misleading to investors. This concentration of the genesis supply directly contradicts PEPE's public image and the team's website claims.

Source: Bubblemaps

The investigation by Bubblemaps found that the same cluster of wallets holding the massive 30% supply then executed a large sell-off, dumping $2 million worth of PEPE tokens just one day after the launch. This significant, coordinated early selling introduced heavy downward pressure on the token's price, which Bubblemaps suggests was a factor in preventing the token from reaching the major $12 billion market capitalization milestone.

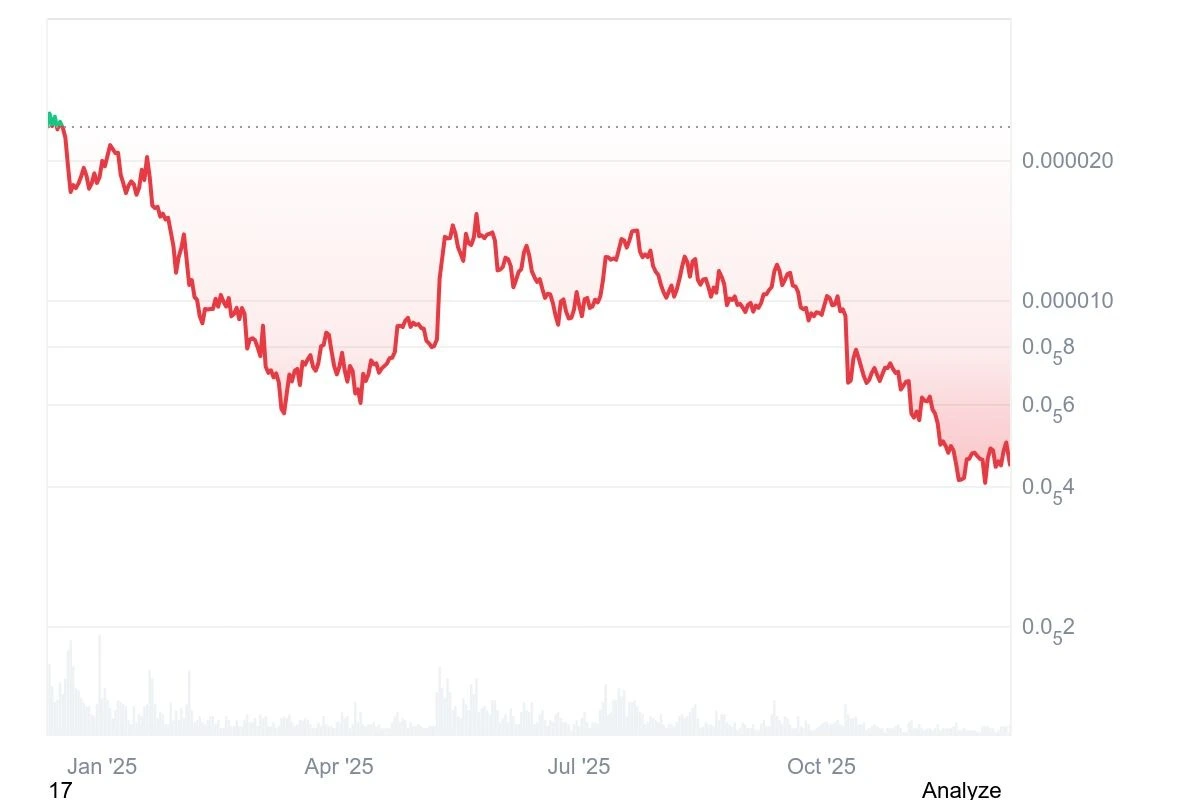

PEPE/USD, one-year chart. Source: CoinMarketCap.com

Adding to the controversy, PEPE's price has struggled, falling 5.7% in the past 24 hours and currently trading over 81% down from its all-time high over the past year. Separately, the project also dealt with a security issue earlier in December when the PEPE website was exploited, temporarily redirecting users to a malicious "inferno drainer" scam tool used for phishing and wallet draining.

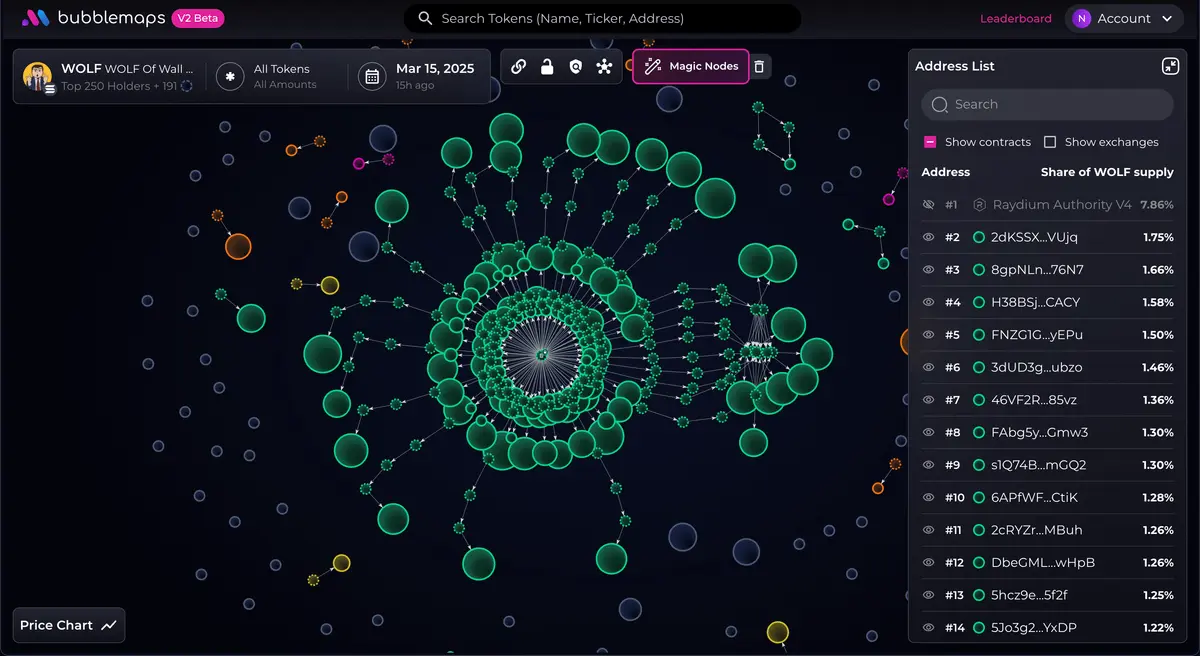

These findings were made possible by Bubblemaps' Time Travel feature, a sophisticated forensic analytics tool launched in May. This tool is designed to reconstruct a token's historical distribution, allowing analysts to spot signs of early insider activity or coordinated accumulation efforts that can precede rug pulls and memecoin scams.

Identifying tokens where a large proportion of the supply is concentrated in a few wallets is a crucial red flag for potential scams, where insiders remove liquidity or stage a mass sell-off, causing the token's value to collapse. Despite the price issues and alleged centralization, the PEPE memecoin still managed to create significant wealth for some; one trader, for example, reportedly turned an initial investment of $2,000 into a paper value of $43 million and realized a $10 million profit.

Source: Bubblemaps