Wallets connected to the troubled Libra (LIBRA) token continue to move large sums of money across the crypto market, even as the project remains under heavy scrutiny. New on-chain activity shows that these addresses are still draining liquidity from the collapsed memecoin and redirecting those funds into other digital assets, with Solana becoming their latest major target.

Recent blockchain data reveals that nearly $4 million was pulled out from Libra’s liquidity pools and used to buy a significant amount of Solana (SOL) during the market dip. In total, the wallets acquired around $61.5 million worth of SOL at an average price of $135.

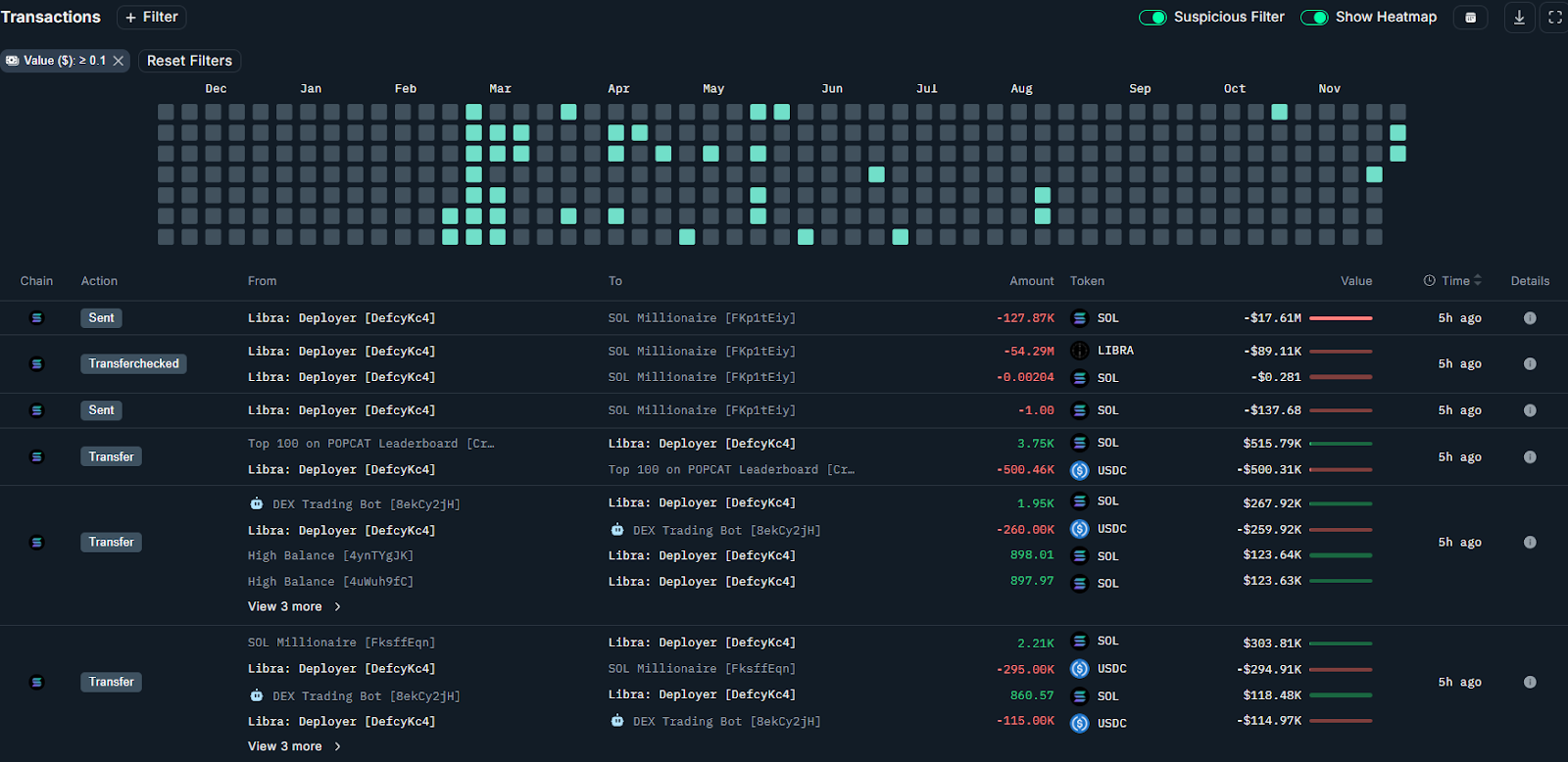

The buying was carried out through two well-known wallet addresses identified by Nansen: “Defcy,” labelled as the Libra Deployer, and “61yKS,” known as Libra Wallet. Before making their large Solana purchases, Defcy held about $13 million in USDC, while 61yKS held roughly $44 million in USDC, giving both wallets plenty of liquidity to deploy.

“Libra Deployer” wallet “Defcy,” transaction heatmap. Source: Nansen

These latest transactions add to the ongoing controversy surrounding the Libra token. During its collapse, eight insider wallets reportedly withdrew $107 million in liquidity, triggering a dramatic $4 billion market cap wipeout in a matter of hours. The situation drew even more attention because Libra had been publicly endorsed by Argentine President Javier Milei, a move that earlier fueled excitement but later intensified criticism.

Legal tensions continue to rise as well. Argentine lawyer Gregorio Dalbon has called for an Interpol Red Notice for Libra creator Hayden Davis, arguing that Davis could flee the U.S. given his access to large amounts of capital.

Even with ongoing investigations, the wallets tied to Libra remain active. In May, U.S. Judge Jennifer Rochon froze $57.6 million in USDC linked to a class-action lawsuit accusing crypto venture firm Kelsier Ventures and its co-founders Gideon, Thomas, and Hayden Davis of misleading investors through the Libra token launch.

Later, on August 21, the judge reversed the freeze, stating that unblocking the funds wouldn’t cause “irreparable harm,” noting that the capital required to compensate affected investors still appears to be available.

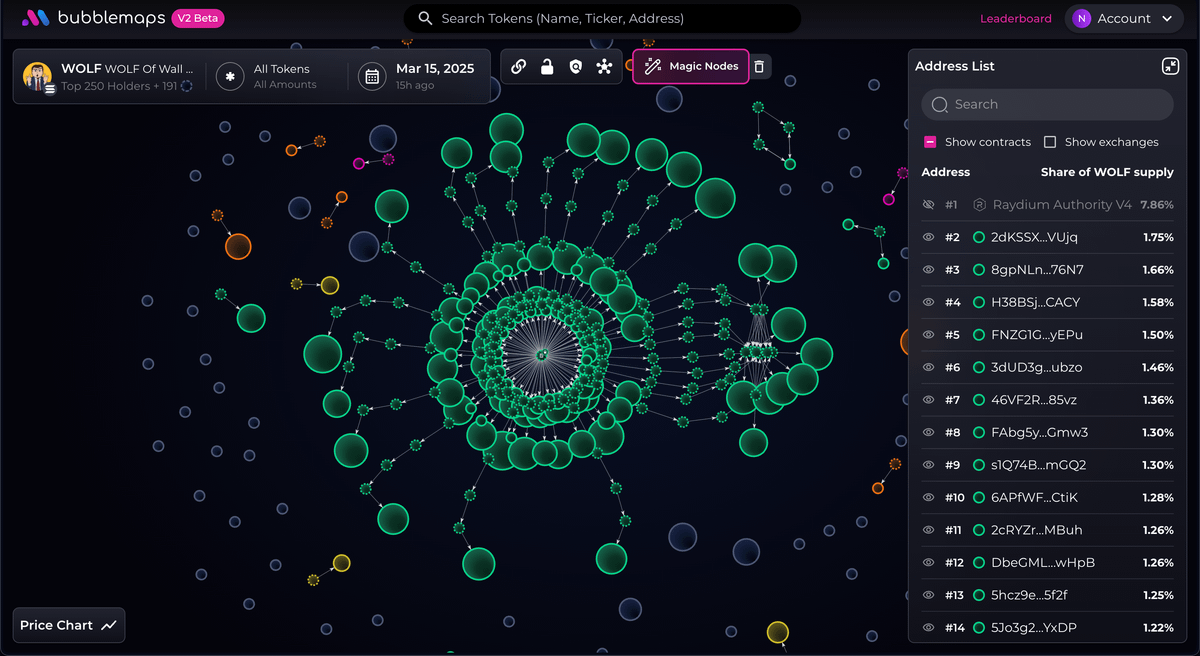

Source: Bubblemaps

Hayden Davis’ involvement in other controversial memecoin projects has only added to concerns. He co-created the Official Melania Meme (MELANIA) token and the Wolf of Wall Street-themed WOLF coin, the latter of which collapsed by 99% within two days due to insiders reportedly holding more than 80% of its supply.

The new activity from these wallets suggests a shift in approach. Instead of pushing new insider-heavy memecoins, the operators are focusing on major altcoins like Solana during the market correction. Even with legal questions looming, the continued movement of millions shows that the wallets behind Libra are still active, and still making bold market moves that raise questions about accountability and the fate of the remaining funds.