It's official: crypto isn't just a speculation game anymore for Asia’s wealthiest. A major new report reveals that high-net-worth individuals (HNWIs) across the region are embracing digital assets, not as a quick gamble, but as a core pillar of their long-term wealth and legacy plans.

The Sygnum’s APAC HNWI Report 2025, which polled 270 wealthy investors with over $1 million in investable assets, paints a clear picture of this seismic shift. A staggering 6 out of 10 of these Asian millionaires plan to ramp up their crypto buying over the next few years. This surge of confidence is driven by a strong, optimistic outlook for the digital asset market over the two- to five-year horizon.

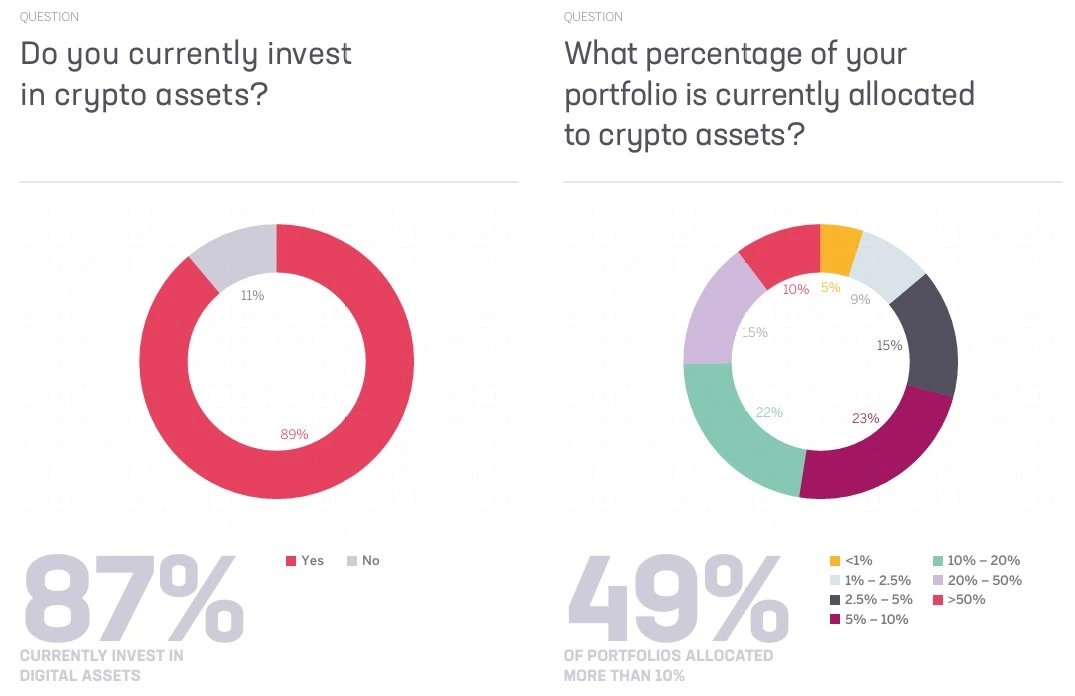

Forget the idea that the super-rich are dipping their toes; they're already deep in the pool! The survey found that a massive 87% of Asia’s HNWIs already have some form of crypto exposure. Moreover, the average allocation stands at a substantial 17% of their total portfolio, with approximately half of the respondents holding more than 10%.

This isn't the “get rich quick” crowd from the 2017 boom. Sygnum co-founder and APAC CEO, Gerald Goh, emphasised this difference: “These aren’t speculators, they’re investors with 10-20 year time horizons thinking about intergenerational wealth transfer.”

The most common reason for this conviction? Portfolio diversification was cited by 56% of those surveyed. And their investments aren't just in obscure tokens; 80% of active investors hold major blockchain protocol tokens like Bitcoin (BTC), Ether (ETH), and Solana (SOL).

Nearly half of the portfolios hold more than 10% in crypto. Source: Sygnum

Crucially, an overwhelming 90% of the HNWIs surveyed view digital assets as “important for long-term wealth preservation and legacy planning, not purely speculation.” This marks a fundamental transition from crypto being seen as a fringe, risky asset to an institutional-grade wealth management tool.

“Digital assets are now firmly embedded within APAC’s private wealth ecosystem,” said Gerald Goh. “Despite near-term macro uncertainty, we continue to see accelerating adoption driven by strategic portfolio diversification, intergenerational wealth planning, and demand for institutional-grade products.”

Another key takeaway is that Asia’s regulatory environment, particularly in hubs like Singapore and Hong Kong, is fostering this institutional adoption. While some may see Asia’s rules as restrictive, Goh argues they are actually “specific and deliberate.”

He pointed to the efforts of the Monetary Authority of Singapore (MAS): “MAS in Singapore has been extraordinarily thoughtful. Yes, they’ve tightened licensing requirements, increased capital buffers, and restricted retail access.”

But the upside of this rigorous approach is genuine clarity on standards for custody, operations, and investor protection.

“What looks 'restrictive' is actually rigorous institution-building. The tradeoff is that fewer service providers can meet the bar, but the ones that do are genuinely institutional-grade,” Goh explained. This regulatory clarity is exactly what sophisticated investors need. In fact, 87% of investors said they would ask their private bank or advisor to add crypto services if offered through regulated partners.

The message is clear: Asia’s wealthy are not just curious, they are committed to integrating digital assets into their futures, and they’re demanding their private banks follow suit.